BEST Free AI Photo editor 2024

Instantly And Easily Edit Image In ZMO AI Photo Editor

Welcome to a new age of photo editing. Say goodbye to Photoshop and edit image like magic with ZMO AI Photo Editor

Explore ZMO AI Photo Editor

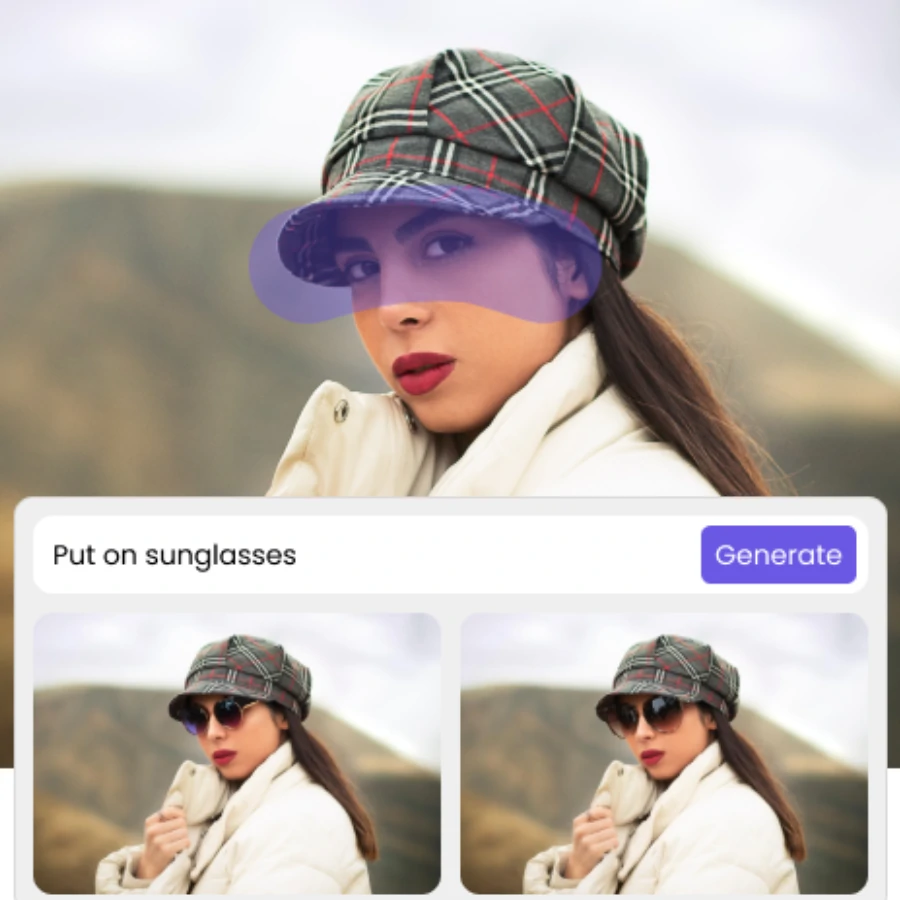

Generative Fill as simple as a snap

ZMO AI’s AI-powered generative fill simplifies the editing process by allowing easy filling, modification, and removal of image components with just a few clicks. Leveraging machine learning to analyze each pixel for lighting, perspective, color, and shadow, it creates highly realistic parts or entire composite photos faster than a human could. As a non-destructive tool, it constructs each element into its own layer with a mask, facilitating easy reversions. Furthermore, it enhances the flexibility of your ZMO.AI experience, since it works in conjunction with features like blending modes or filter effects and is integrated with your well-known ZMO AI keyboard shortcuts.

Swap Face Hyper Seamlessly

Are you dissatisfied with the lackluster outcomes of traditional AI Face Swap Apps? Do you aim to not simply exchange faces, but fully substitute individuals, encompassing skin color? ZMO AI Image Editor assures the most genuine and seamless face swap results:

Succeed with our AI-driven people face swap that handles intricate details, specifically at the junctions of hair and face, with finesse.

Accomplish precise, tailor-made results that cater to your desires—if you aim to morph into a black woman, we change all skin color, inclusive of the arms and chest.

Regardless of the project’s complexity, every lighting and shadow detail is thoughtfully handled. It’s crafted so meticulously that you won’t believe it’s generated by AI.

Generate AI Fashion Model With Less Cost

AI fashion models primarily function to create an unlimited number of model images using simple product photos, significantly reducing costs. The platform is both fast and efficient, allowing users to visualize their products on models within minutes. It emphasizes diversity and inclusivity by providing a realistic look of products on a range of ethnically diverse digital models. Additionally, the need for photographers, models, studios, and post-processing is eliminated with ZMO, further cutting down on expenses.

- Unlimited model images: Create infinite images with an assortment of models

- Diversity and inclusivity: Featuring a range of ethnically diverse digital models.

- Customizable options: Provide the flexibility to change models and looks without additional expense

- Cost reduction: Significantly lower the costs associated with model photography

- Cost reduction: Significantly lower the costs associated with model photography

AI Photo Editor with Magic Remover

ZMO’s Magic Eraser allows you to quickly remove any unwanted aspects from your pictures. This tool excels in clearing anomalies from AI-generated images or naturally occurring errors. While maintaining the authentic character of your photo, the Magic Eraser subtly eliminates these issues. Its flawless performance provides a simple solution to correct image imperfections, making them virtually vanish. With minimal effort, the tool enables you to create impeccably organized visuals:

- remove your ex

- remove extra people

- remove watermark

- remove unwanted objects

- remove text

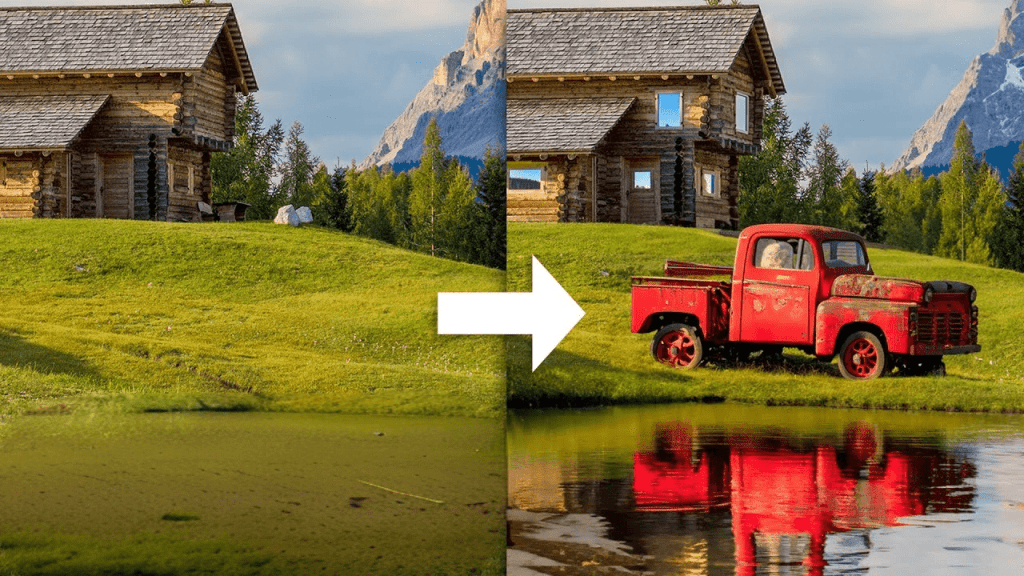

AI Edit Photo for Background Change

In the e-commerce world, the key to effective marketing often lies in skillfully handling your product images. Their importance goes beyond mere aesthetic appeal; it’s vital to tweak them for maximum sales across every possible channel. ZMO’s AI Image Editor meets this need by changing the background to your desired scene and creating multiple content variations for efficient A/B testing. This can boost customer engagement and set the stage for higher conversion rates.

To sell products online, you need to present high-quality images. This essential component draws in potential customers, leading to a rise in click-through rates. As a result, it increases your visibility and presents more opportunities for sales.

AI Photo Editor with Magic Remover

ZMO’s Image Resizer is a robust, intuitive solution that provides an extensive selection of templates for adjusting image dimensions to suit the requirements of various social media platforms. This tool allows users to effortlessly select the ideal size for their images, guaranteeing optimal display on platforms like Instagram, Facebook, Twitter among others. Furthermore, the option to pick from multiple pre-determined sizes ensures users can sustain a uniform and polished look across all their social media profiles. In essence, ZMO’s Image Resizer equips individuals with an easy-to-use method to scale and optimize their images for the greatest possible impact on social media.

How do I edit my Photo using AI

Upload

For the best outcome, choose a picture where the subject has clear borders and doesn't overlap with any other elements.

Mask Out

Use mouse to mask out the area you want to edit or simply choose pre-set option for area you want to edit

Text Prompt

Simply input text description for the final change you want to make

Generate

Hit Generate and iterate to get close to your final result.

Recommended By Expert

They love us. You will too

AI Photo Editor

Save hours and thousands of dollars by using ImgCreator today

?

ImgCreator.AI and Topaz Photo AI are both aimed at photographers, but offer a lot of control and power. Tools like Let’s Enhance, Claid, remove.bg, and Slazzer can use AI to automate aspects of your image editing workflow.

| Editor | About |

|---|---|

| ImgCreator | ImgCreator is a powerful AI photo editor platform with AI extras |

| Pixlr | Pixlr is an easy-to-use image-editing platform with separate AI apps |

| Canva | Canva is a powerful design platform with AI extras |

Simply upload your photo, mask the area you want to edit, and type in prompt to describe your ideal change. Then the result will be generated in seconds.